Social Security Benefits Update

Important Update for Our Customers Receiving Social Security Benefits Starting September 30, 2025, the U.S. Department of the Treasury will no longer issue paper checks for most federal payments—including Social Security, Veterans benefits, and other federal benefits. This change is part of a nationwide effort to make payments safer, faster, and more secure. If you […]

Post Summer Holiday Savings

Do you hear that? It’s the sound of holiday cheer, which is just around the corner. Soon the weather will be cooler, holiday decorations will start appearing around town, and holiday music will be playing on the radio. And, while that all sounds so cheerful, it can also start to feel overwhelming. By planning ahead […]

Back-to-School Budgeting

The summer break is almost over, and the first day of school will soon be upon us. It usually arrives much quicker than expected! While there’s excitement and anticipation in the air, there is no doubt some anxiety lingering as well. As a parent, you want to make sure that everything goes smoothly for the […]

Why Spend Your College Summer Interning?

NDBT’s annual college summer internship program includes the opportunity for students to experience and learn the various roles within the bank. During their session with NDBT’s MarCom (marketing/communications) department, this summer’s four interns were asked to share their thoughts on why spending a college summer interning is an important step towards a student’s future. After […]

Reduciendo los miedos a ser propietario de una vivienda

El mes de Junio tajo la primera ola de calor, actividades de verano y más tiempo con la familia. Es un período en el que muchas personas y familias se preparan para conquistar la segunda mitad del año. Junio también es el Mes Nacional de la Propiedad de Vivienda. Con el mercado inmobiliario típicamente creciendo […]

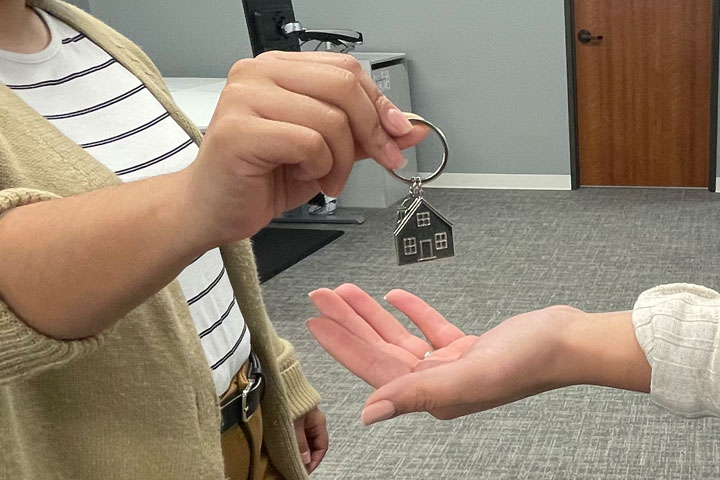

Reducing the Fear Factor of Homeownership

The month of June brought the first wave of heat, summer-filled activities, and a bit more time spent with family. It is a period where many individuals and families prepare to conquer the second half of the year. June also happened to be National Homeownership month. With the real estate market typically blooming in the […]

Making Intelligent Financial Business Decisions

It seems everyone is talking about the economy these days. During the recent holidays, I had family members ask me where I thought interest rates were headed in 2024. Earlier in 2023, it was all about inflation. Who knows what the hot topic will be this year. In general, I try not to set firm […]

Empowering Communities: The Merits of Community Banking

When I was young, the dream of owning my first car ignited a sense of ambition within me. My father encouraged me to start my journey with a simple act – open a savings account at my local community bank, Security State Bank in Lubbock, Texas. Fueled by this determination and commitment, I deposited my […]

Homeownership within the Hispanic Community

Every year, Hispanic Heritage Month celebrates the many contributions and achievements the Hispanic and Latino communities have contributed to the United States. It allows us to reflect on our culture, family, values, and our successes as a people. It is also used as an avenue to think about the ways our community can continue to […]

The Home Buyers’ Process: Preparing to Buy

September is National Mortgage Professionals Month* You may be buying a home for the first time, or it has been a while since you have gone through the experience. Either way, you may not be completely clear on the current home-buying process, so let us set the correct expectations and transparency for the home buying […]