September is National Mortgage Professionals Month*

The first step you should take before even looking at homes is to get prequalified with a mortgage lender. It will help you, as a buyer, better understand your target home price range and what that will mean for your monthly and overall budget. In addition, your realtor will most likely want to know that you are already in discussions with a mortgage lender so they can help you narrow down your home search. Also, the seller will typically expect to see a prequalification letter to accompany any offer before accepting, adding to the importance of this first step.

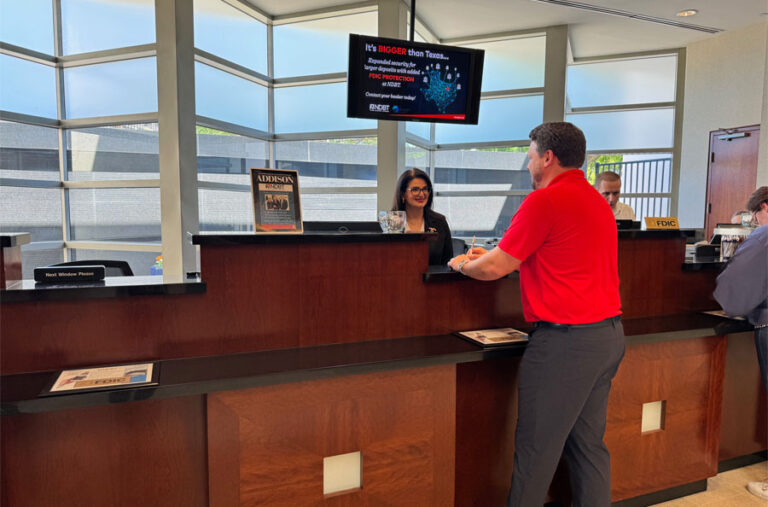

To get the prequalification process started, you will need to complete a mortgage application. Once this application has been received, a loan originator will then follow up to go through your information, better understand your needs and collect any financials that may be required. As originators better understand your financials and objectives, they can more clearly guide you through the best loan products and rates available to help meet your needs.

It is important to realize the initial conversations in this process relate to market rates at that specific moment in time. Rates can, and often do, move up and down until the point you “lock” a rate. Rate locks are not performed until after your application becomes property specific and is disclosed as “locked.” If you have not seen a Loan Estimate from your lender showing the rate is “locked” then it is more than likely still subject to changing market conditions.

Once you and your lender find the price range and product that fits your budget, a prequalification letter will be prepared to share with your realtor. You are now ready to begin shopping for your future home!

The next steps in the process involve submitting an offer, acceptance by the seller, and sending the contract to your lender where the home buying process will officially begin!

*This is part one of a two-part series on the home buying process created by NDBT mortgage professionals.