Reduciendo los miedos a ser propietario de una vivienda

El mes de Junio tajo la primera ola de calor, actividades de verano y más tiempo con la familia. Es un período en el que muchas personas y familias se preparan para conquistar la segunda mitad del año. Junio también es el Mes Nacional de la Propiedad de Vivienda. Con el mercado inmobiliario típicamente creciendo […]

Reducing the Fear Factor of Homeownership

The month of June brought the first wave of heat, summer-filled activities, and a bit more time spent with family. It is a period where many individuals and families prepare to conquer the second half of the year. June also happened to be National Homeownership month. With the real estate market typically blooming in the […]

Climb the CD Ladder Toward Savings Success!

Why a CD Ladder Might Be a Smart Move for You When saving money, many people look for options that offer security, steady growth, and flexibility. But it’s not just about how much you save—it’s about how smartly you save. While your checking and savings accounts are great for day-to-day needs, one smart savings strategy […]

IRS: Dirty Dozen Tax Scams for 2025

The following was released by the IRS and posted on IRS.gov WASHINGTON (February 27, 2025) — The Internal Revenue Service today announced its annual Dirty Dozen list of tax scams for 2025 with a warning for taxpayers, businesses and tax professionals to watch out for common schemes that threaten their tax and financial information. Ranging […]

How to be Financially Healthy in a New Year

I grew up in a small town in Northeast Texas where everyone knew your name and looked out for one another, so moving to Dallas after graduating college was a big change. When looking to start a new banking relationship it was very important for me to find a bank with bankers who would truly […]

Protecting Yourself Against Identity Theft

Each year, identity theft continues to be one of the fastest growing crimes in the United States. According to the Federal Trade Commission (FTC), over 800,000 ID theft reports were filed in 2023. Over half of those reports related to credit card or bank fraud. NDBT recommends following these tips to keep your information – […]

Financial Wellness Video Series

New Year’s resolutions are typically created to help us focus on areas of our own personal improvement. It’s no wonder January is National Financial Wellness Month! Our financial experts share a variety of tips and steps you can take to help with that focus – from estate planning to personal financial statements and more – […]

The Impact of the Beneficial Ownership Injunction

Beneficial Ownership Filing Requirement on Hold: The Impact of the Injunction 1/2/25 UPDATE – As the World Turns On 12/26/24, the US Court of Appeals for the Fifth Circuit reversed their 12/23/24 ruling and again paused the filing requirement of the Corporate Transparency Act. The portal is still functional, and businesses may voluntarily submit the […]

Smishing… Don’t Take the Bait!

You may have heard of email phishing, but have you heard of smishing? Smishing (SMS phishing) involves deceptive text messages that try to get you to act or respond. A typical smishing attempt may seem like it’s from your bank or the IRS and include a link or phone number to bait you into clicking […]

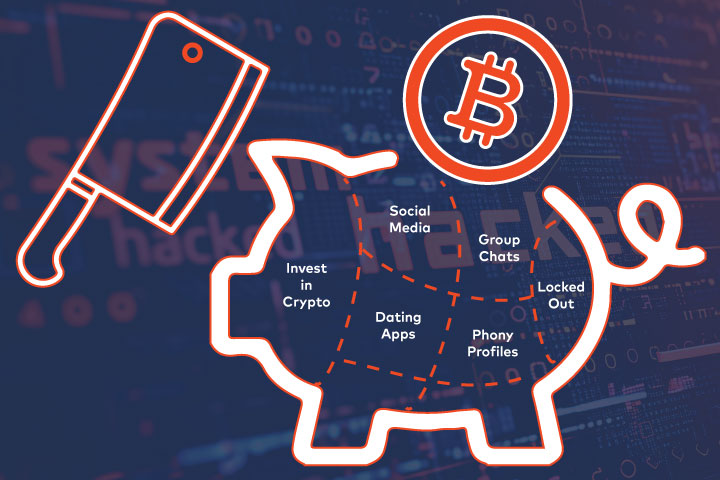

Pig Butchering Scams on the Rise

This story you are about to read is a real-life story of a recently divorced, middle-aged NDBT female customer who fell victim to a financial grooming scam that started as a romantic relationship with a foreign male working overseas. After responding to a message on the Hinge app, “Louis” almost immediately asked for her phone […]