Climb the CD Ladder Toward Savings Success!

Why a CD Ladder Might Be a Smart Move for You When saving money, many people look for options that offer security, steady growth, and flexibility. But it’s not just about how much you save—it’s

NDBT bankers and professionals share their expertise in topics that range from cybersecurity to trends affecting your financial wellbeing…and everything in between. Their voices delivered through the written word and video messages. Enjoy!

Why a CD Ladder Might Be a Smart Move for You When saving money, many people look for options that offer security, steady growth, and flexibility. But it’s not just about how much you save—it’s

The following was released by the IRS and posted on IRS.gov WASHINGTON (February 27, 2025) — The Internal Revenue Service today announced its annual Dirty Dozen list of tax scams for 2025 with a warning

I grew up in a small town in Northeast Texas where everyone knew your name and looked out for one another, so moving to Dallas after graduating college was a big change. When looking to

Each year, identity theft continues to be one of the fastest growing crimes in the United States. According to the Federal Trade Commission (FTC), over 800,000 ID theft reports were filed in 2023. Over half

New Year’s resolutions are typically created to help us focus on areas of our own personal improvement. It’s no wonder January is National Financial Wellness Month! Our financial experts share a variety of tips and

Beneficial Ownership Filing Requirement on Hold: The Impact of the Injunction 1/2/25 UPDATE – As the World Turns On 12/26/24, the US Court of Appeals for the Fifth Circuit reversed their 12/23/24 ruling and again

You may have heard of email phishing, but have you heard of smishing? Smishing (SMS phishing) involves deceptive text messages that try to get you to act or respond. A typical smishing attempt may seem

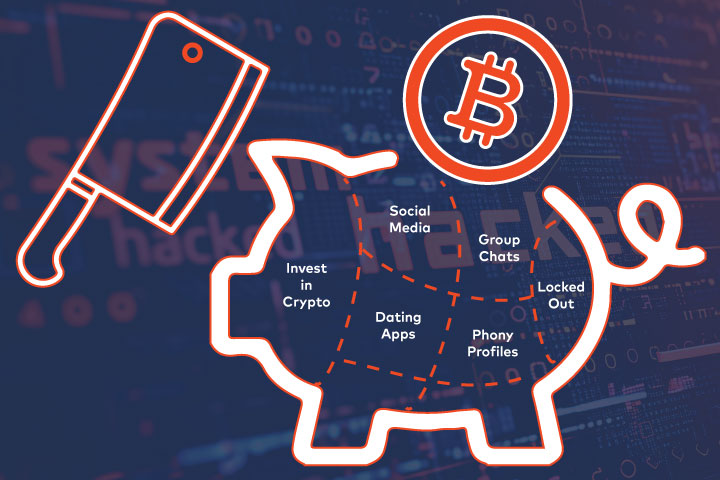

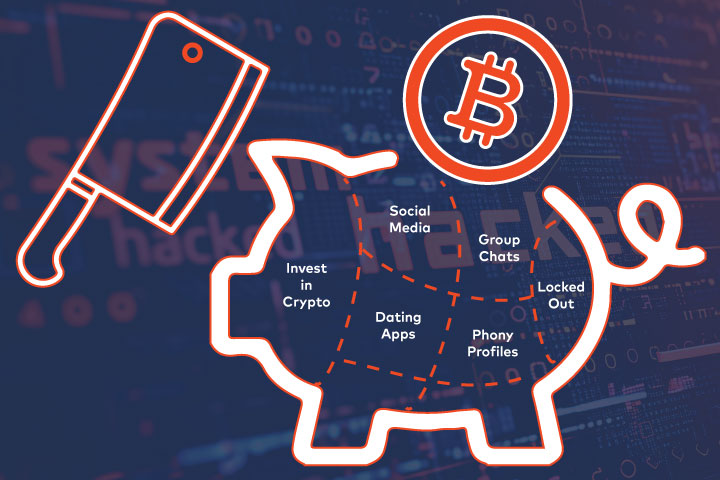

This story you are about to read is a real-life story of a recently divorced, middle-aged NDBT female customer who fell victim to a financial grooming scam that started as a romantic relationship with a

Open AI’s recent release of ChatGPT has generated a lot of interest and media buzz as the application set records as the fastest application to reach 1 million users (five days) and then 100 million

The Federal Open Market Committee (FOMC) meeting is scheduled for September 17-18. During that time, the Fed is expected to reduce rates for the first time since March 2022. Beginning in March of 2022, The

Romance scams are one of the numerous money-mulling sources of feed for criminals intending to fund terrorism, laundry proceeds from drugs and human trafficking. This type of scam is an intricately operated business aiming to

*June 15th is Elder Abuse Awareness Day One thing we can all hope to do is to live a long life and enjoy our elder years. Many will save their whole life to prepare for

As a community banker I am trained to listen carefully to neighbors, friends, relatives, and contacts wherever I go, for an opportunity to help. Help can come in many forms – lending a hand with

It seems everyone is talking about the economy these days. During the recent holidays, I had family members ask me where I thought interest rates were headed in 2024. Earlier in 2023, it was all

When I was young, the dream of owning my first car ignited a sense of ambition within me. My father encouraged me to start my journey with a simple act – open a savings account

Why a CD Ladder Might Be a Smart Move for You When saving money, many people look for options that offer security, steady growth, and flexibility. But it’s not just about how much you save—it’s

The following was released by the IRS and posted on IRS.gov WASHINGTON (February 27, 2025) — The Internal Revenue Service today announced its annual Dirty Dozen list of tax scams for 2025 with a warning

I grew up in a small town in Northeast Texas where everyone knew your name and looked out for one another, so moving to Dallas after graduating college was a big change. When looking to

Each year, identity theft continues to be one of the fastest growing crimes in the United States. According to the Federal Trade Commission (FTC), over 800,000 ID theft reports were filed in 2023. Over half

New Year’s resolutions are typically created to help us focus on areas of our own personal improvement. It’s no wonder January is National Financial Wellness Month! Our financial experts share a variety of tips and

Beneficial Ownership Filing Requirement on Hold: The Impact of the Injunction 1/2/25 UPDATE – As the World Turns On 12/26/24, the US Court of Appeals for the Fifth Circuit reversed their 12/23/24 ruling and again

You may have heard of email phishing, but have you heard of smishing? Smishing (SMS phishing) involves deceptive text messages that try to get you to act or respond. A typical smishing attempt may seem

This story you are about to read is a real-life story of a recently divorced, middle-aged NDBT female customer who fell victim to a financial grooming scam that started as a romantic relationship with a

Open AI’s recent release of ChatGPT has generated a lot of interest and media buzz as the application set records as the fastest application to reach 1 million users (five days) and then 100 million

The Federal Open Market Committee (FOMC) meeting is scheduled for September 17-18. During that time, the Fed is expected to reduce rates for the first time since March 2022. Beginning in March of 2022, The

Romance scams are one of the numerous money-mulling sources of feed for criminals intending to fund terrorism, laundry proceeds from drugs and human trafficking. This type of scam is an intricately operated business aiming to

*June 15th is Elder Abuse Awareness Day One thing we can all hope to do is to live a long life and enjoy our elder years. Many will save their whole life to prepare for

As a community banker I am trained to listen carefully to neighbors, friends, relatives, and contacts wherever I go, for an opportunity to help. Help can come in many forms – lending a hand with

It seems everyone is talking about the economy these days. During the recent holidays, I had family members ask me where I thought interest rates were headed in 2024. Earlier in 2023, it was all

When I was young, the dream of owning my first car ignited a sense of ambition within me. My father encouraged me to start my journey with a simple act – open a savings account

This link will take you away from NDBT‘s website and will redirect you to another site outside our domain. NDBT makes no endorsements or claims about the accuracy or content of the information contained in these sites and the security and privacy policies on these sites may be different than those of NDBT.