Financial Literacy - CD's Explained

Have you ever wondered what a CD is? For some of you who might remember, we’re not referring to the musical compact disc, which has mostly been replaced by streaming media. A Certificate of Deposit (CD), in bank terms, is a savings tool that allows you to typically earn a higher interest rate than a traditional savings account on a set amount for a fixed period of time.

This means the money you choose to set aside for a CD will increase and earn you more money.

For example, when setting up a CD you can choose a term anywhere between 30 days and 10 years, depending on what is offered at your financial institution. Choosing the term depends on how long you are comfortable with setting your money aside without accessing it. The amount you earn from opening the CD depends on the interest rate and annual percentage yield offered for the term you select. If you happen to need your money before the term is fulfilled, this can result in an early withdrawal penalty, which is a percentage collected by the bank based on the amount withdrawn and the term.

Is the money in a CD insured by the FDIC?

Yes! It is insured up to the current FDIC limit of $250,000 per depositor, per financial institution, per ownership category. This coverage can also be increased by joining our IntraFi program.

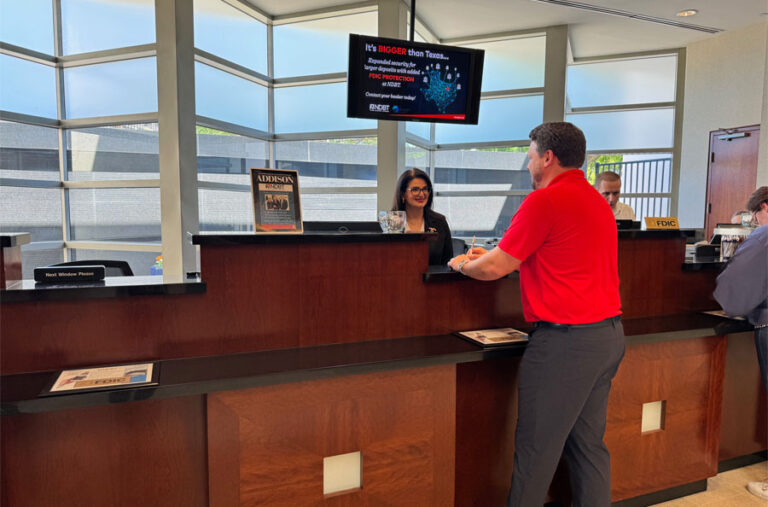

For more information, visit one of our banking centers and let us help you grow your money!!!