Financial Wellness Video Series

New Year’s resolutions are typically created to help us focus on areas of our own personal improvement. It’s no wonder January is National Financial Wellness Month! Our financial experts share a variety of tips and steps you can take to help with that focus – from estate planning to personal financial statements and more – […]

The Impact of the Beneficial Ownership Injunction

Beneficial Ownership Filing Requirement on Hold: The Impact of the Injunction 1/2/25 UPDATE – As the World Turns On 12/26/24, the US Court of Appeals for the Fifth Circuit reversed their 12/23/24 ruling and again paused the filing requirement of the Corporate Transparency Act. The portal is still functional, and businesses may voluntarily submit the […]

Smishing… Don’t Take the Bait!

You may have heard of email phishing, but have you heard of smishing? Smishing (SMS phishing) involves deceptive text messages that try to get you to act or respond. A typical smishing attempt may seem like it’s from your bank or the IRS and include a link or phone number to bait you into clicking […]

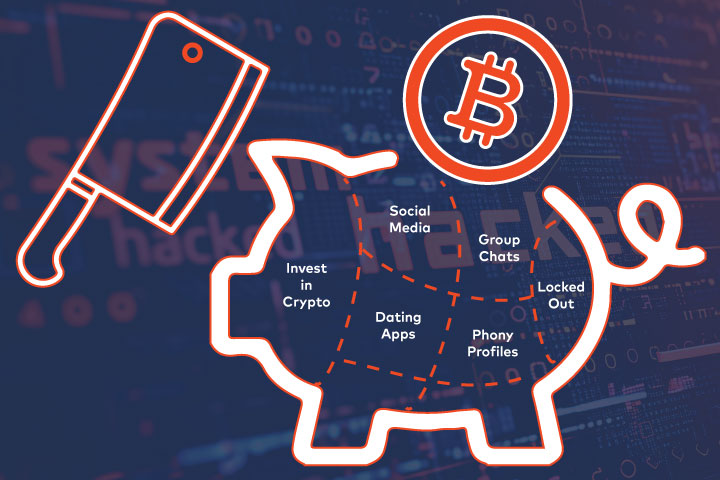

Pig Butchering Scams on the Rise

This story you are about to read is a real-life story of a recently divorced, middle-aged NDBT female customer who fell victim to a financial grooming scam that started as a romantic relationship with a foreign male working overseas. After responding to a message on the Hinge app, “Louis” almost immediately asked for her phone […]

Anticipating the Fed: How Will a Rate Drop Affect You?

The Federal Open Market Committee (FOMC) meeting is scheduled for September 17-18. During that time, the Fed is expected to reduce rates for the first time since March 2022. Beginning in March of 2022, The Federal Reserve Board (“Fed”) implemented a strategy of interest rate management designed to reduce inflation and slow down our national […]

Fighting Sweetheart/Romance Scams is a Team Effort

Romance scams are one of the numerous money-mulling sources of feed for criminals intending to fund terrorism, laundry proceeds from drugs and human trafficking. This type of scam is an intricately operated business aiming to allure, “financially groom,” and eventually deplete their victims of their money. By adopting fake identities online, highly trained individuals dedicate […]

The 3 U’s of Elder Abuse: Urgent, Unsettling, and Unexpected

*June 15th is Elder Abuse Awareness Day One thing we can all hope to do is to live a long life and enjoy our elder years. Many will save their whole life to prepare for retirement. Unfortunately, this nest egg puts a target on the back of many of our loved ones. Elder financial abuse […]

Helping Small Businesses Grow – A Community Banker’s Story

As a community banker I am trained to listen carefully to neighbors, friends, relatives, and contacts wherever I go, for an opportunity to help. Help can come in many forms – lending a hand with yard work, helping someone repair their car, preparing a meal for a family in need, or a million other ways. […]

Making Intelligent Financial Business Decisions

It seems everyone is talking about the economy these days. During the recent holidays, I had family members ask me where I thought interest rates were headed in 2024. Earlier in 2023, it was all about inflation. Who knows what the hot topic will be this year. In general, I try not to set firm […]

Empowering Communities: The Merits of Community Banking

When I was young, the dream of owning my first car ignited a sense of ambition within me. My father encouraged me to start my journey with a simple act – open a savings account at my local community bank, Security State Bank in Lubbock, Texas. Fueled by this determination and commitment, I deposited my […]